Source: Center for Asia and the Emerging Economies.

Tuck

School of Business. Dartmouth University.

Economic Analysis of Trade Barriers

July

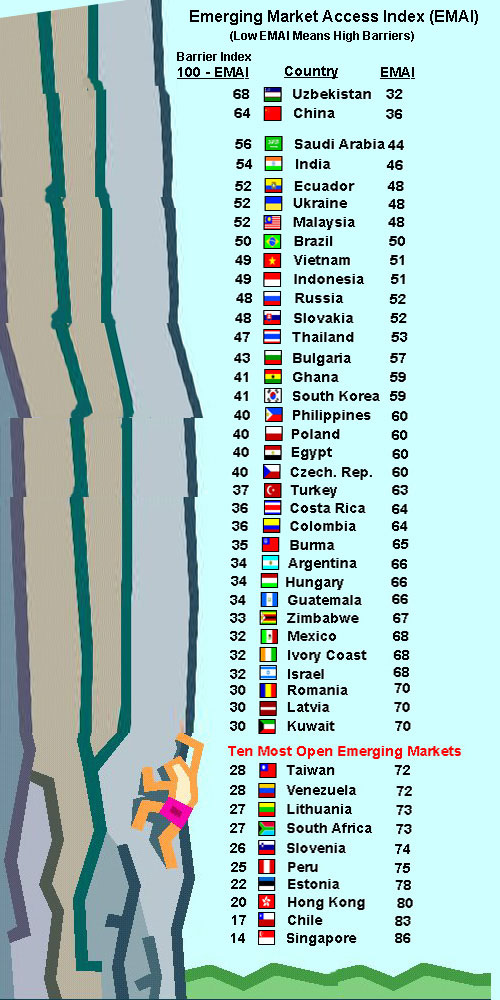

25, 2000 The Center for Asia and the Emerging Economies at the

Tuck

School of Business at Dartmouth University launched its Emerging Market

Access Index (EMAI) in May. The inaugural EMAI ranks 44 countries

in terms of the level of access afforded to foreign goods, services,

and

investment. The higher the index rating, the easier it is to

conduct

international commerce in a given country. Countries with a low

EMAI

have relatively high trade barriers.

July

25, 2000 The Center for Asia and the Emerging Economies at the

Tuck

School of Business at Dartmouth University launched its Emerging Market

Access Index (EMAI) in May. The inaugural EMAI ranks 44 countries

in terms of the level of access afforded to foreign goods, services,

and

investment. The higher the index rating, the easier it is to

conduct

international commerce in a given country. Countries with a low

EMAI

have relatively high trade barriers.

Singapore, Chile, Hong Kong, Estonia, and Peru are the five highest ranking countries with relatively low trade barriers. Uzbekistan, China, Saudi Arabia, and India are the lowest ranked with the highest barriers of the 44 countries studied.

The full EMAI and its database will soon be available (free of charge) at the Center's web site; and the Center expects the next version of the EMAI, scheduled for release in May 2001, to include an expanded group of countries. According to the Center's press release, "Because the EMAI database highlights problem areas of market access, it will help policy makers, trade negotiators, business executives, journalists, and others in monitoring and comparing progress or regress in implementation of market liberalization."

The EMAI panel of experts assesses the openness of the emerging markets on 16 areas of market access including:

Non-tariff barriers are less transparent than tariffs, but they can be formidable obstacles to international commerce. Customs procedures can often be bureaucratic. Import licensing and quotas can be used effectively to restrict the supply of foreign products into a country. Product standards are often tailored to favor domestic product designs and production techniques. A few countries have domestic content laws which require that a certain per cent of a product's value added be produced in the home country. Some countries subsidize domestic producers and exporters, giving them an "unfair" advantage over unsubsidized foreign producers. Intellectual property rights involving patents, copyright, and trademark enjoy different degrees of safeguard. Foreign investment codes can restrict direct and portfolio capital flows both into and out of a country. Poor financial and telecommunication facilities can make it difficult to accommodate international transactions. Taken altogether, non-tariff barriers are the most bewildering and frustrating impediments to international trade and commerce.

The EMAI database provides an excellent account of tariff and non-tariff trade barriers in each of the countries studied. It includes concise and informative narratives for each of the 16 criteria that it reviews to construct the index. Focusing on China, for example, the database monitors China's implementation of its commitments to trade liberalization as a stipulation to joining the World Trade Organization (WTO). The report notes that China has generally lowered tariffs from 42 per cent to 23 per cent in 1996, and again to 17 per cent in 1997. However, the report also notes that "tariff rates for sectors in which China is seeking to build its international competitiveness, such as chemicals and motor vehicles, remain extremely high. In addition to high tariff rates, unpredictable application of those rates creates difficulties for companies trying to export into the Chinese market. Tariffs may vary for the same product, depending on whether the product is eligible for an exemption from the published MFN tariff. Tariffs may also vary depending on the geographical point of entry. Also, local tariffs may be applied to imports even after the importer paid the tariff at the port. Actual customs duties are often the result of negotiation between business persons and local Chinese Customs officers."

China ranks very low in the EMAI import quota category. Import quotas apply to more than 400 products. They are extensively used to keep the Chinese market closed from foreign producers. Although China has been gradually reducing quotas and other quantitative restrictions, some imports are banned including certain printed matter, magnetic media, films and photos. Furthermore, China provides little transparency regarding the quantity or value of products to be imported under a quota. Considering the current status of tariffs, quotas , and other non-tariff barriers, China is ranked among the least open markets among the 44 countries listed in the Center's EMAI.

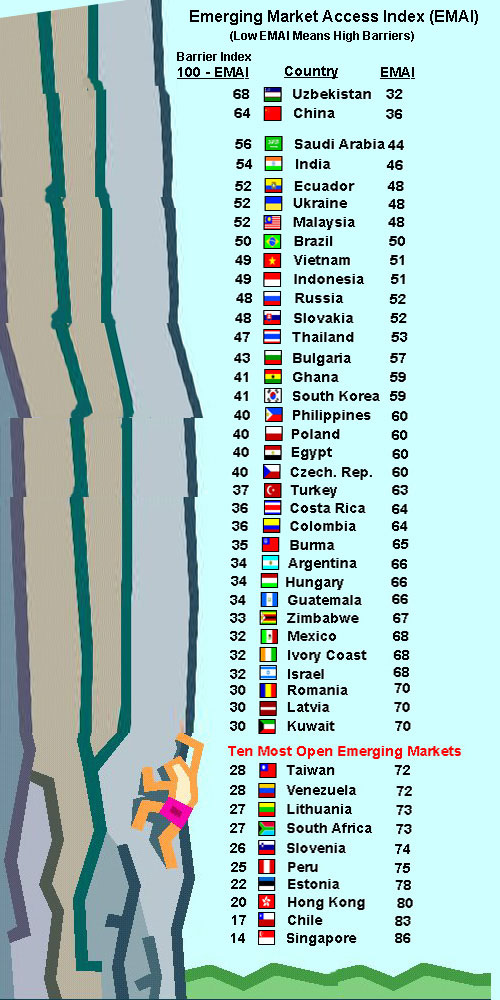

Exporting, investing, and conducting business in newly emerging markets can be compared to scaling a mountain cliff. In some countries the trade barriers are relatively low and somewhat easily overcome. In others the elevation can be very high, indeed, almost insurmountable. The image below depicts the Tuck Research Center's reported EMAI ratings for the 44 countries studied. Countries near the top received low EMAI ratings, because they have very high tariff and non-tariff barriers according to the Center's criteria. Countries lower down the cliff received high EMAI ratings, because they have relatively low barriers in the opinion of the analysts.

Source: Center for Asia and the Emerging Economies.

Tuck

School of Business. Dartmouth University.

Economic Analysis of Trade Barriers

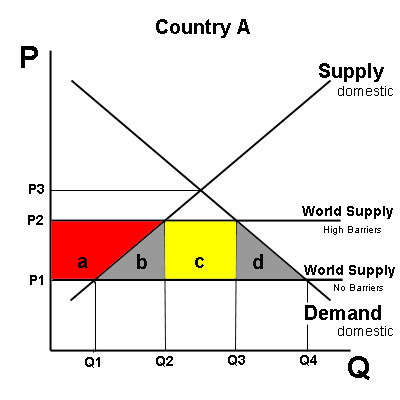

Trade barriers have the effect of raising prices higher than they would otherwise be in the home country if it permitted free trade. They enhance the market shares of "protected" domestic producers and limit the volume of goods and services exported into the country from foreign origins. Prohibitive tariffs and non-tariff barriers can preclude and eliminate imports of some products altogether. Almost every student of international economics is familiar with the analytical diagram below that depicts the static welfare effects of tariffs, quotas and other such trade restrictions. The diagram appears in virtually every leading textbook.

The diagram above depicts the economic effects of trade barriers. If Country A had no barriers, the world price of P1 would prevail in the market. Country A's domestic producers would supply Q1, and the country would import Q4 - Q1 from the rest of the world. Trade barriers restrict the world supply in Country A, and raise the price to P2. Domestic production increases to Q2, and imports are reduced to Q3 - Q2. The total area (a + b + c + d) is a loss in consumer welfare due to the higher prices. The red area (a) is called the redistribution effect, because domestic producers gain at the expense of domestic consumers. The yellow area (c) is called the revenue effect. If the trade barrier is a tariff, then the government collects area c in the form of tax revenue. If the trade barrier is a quota, then area c may accrue to either the government, domestic importers, or foreign producers. It depends on the circumstances and relative powers in the market. The combined gray areas (b + d) are known as the "deadweight loss" of trade barriers. The consumer loss of areas (b + d) accrues to no one! If trade barriers are prohibitive, the price would rise to P3 and Country A would have no imports. All production and consumption would be domestic.

Trade barriers are the natural consequence of self-interest and political influence. Domestic producers and their workers tend to favor trade barriers as a shield against foreign competition. They tend to be well organized and politically active. In contrast, consumers who benefit from free trade and suffer from protectionism, are dispersed and poorly organized. In addition, many of the trade barriers that are in effect in the world today are the legacy of post WWII economics literature that recommended "import substitution" as a dynamic trade strategy for developing countries. The argument favored trade barriers especially for manufactured products, so that less developed countries could create their own industrial sector and emulate the historical experience of the well developed industrialized economies.

Globalization and trade liberalization trends have been eroding protectionism at an accelerating pace for the past 25 years. Some countries have moved more quickly toward freer trade than others. The EMAI proffers an accounting of these developments in the 44 countries that it has reviewed. It is an outstanding study and provides valuable information for private and public policy makers, as well as professors and students of international economics.

Recommended Link:

Center for Asia and

Emerging

Economies: http://www.dartmouth.edu/tuck/caee/