To answer these questions, the first assignment is to identify which events were more economic than political or social. This is more difficult than one might think. It requires a mental filtering to separate the predominately economic from all the rest. For example, in April President Bush reappointed Alan Greenspan as the Federal Reserve Board Chairman. Is this an economic or political event? It is economic, because Alan Greenspan is an economist and the Fed's chairman orchestrates monetary policy in the United States. However, it is also a political appointment and requires congressional approval.

After one has managed to isolate the predominately economic events, the next step is to decide which of these were important enough to deserve mention. Was Greenspan's reappointment eventful? Or was it uneventful since it merely maintained an existing condition? Would Greenspan's resignation or the appointment of a new chairman have been more eventful?

As the sands of time rain down, there are a multitude of events that transpire in a single year. Selecting the most important economic events is a daunting task, and it is very subjective. One analyst's list could easily be different from another's. That said, this article first lists chronologically what could be considered important economic events that occurred in 2003. As you scan the list, think about which events were the most important. After the timeline, this article identifies and briefly discusses what might be considered the 10 most significant economic events of the year.

Timeline of Key Economic Events in 2003

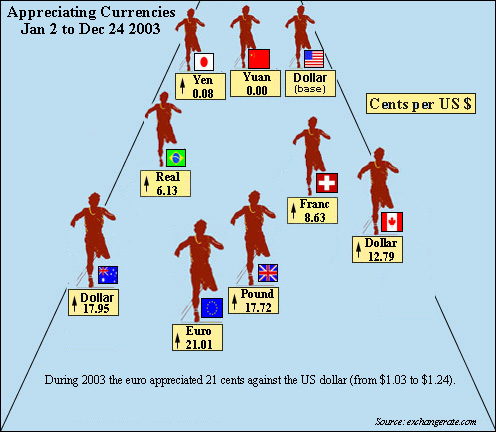

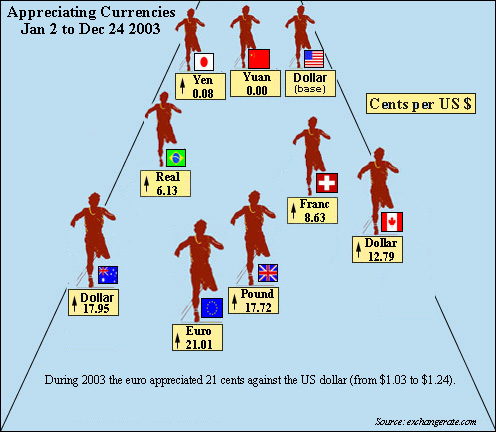

Jan 1: One Euro is worth US $1.03 in the world's foreign exchange markets.

Jan 7: President Bush proposes new tax cuts to stimulate the slumping U.S. economy.

Jan 8: President Bush signs law to extend unemployment benefits to about 2.5 million workers without jobs.

Jan 10: U.S. deploys 62,000 more troops to Persian Gulf, bringing the total to nearly 80,000.

Jan 15: U.S. Supreme Court votes 7–2 to uphold copyright extension law, lengthening existing copyrights by 20 years.

Jan 22: Mexican earthquake in Colima kills nearly 30 people and destroys infrastructure.

Feb 1: Space shuttle Columbia explodes and disintegrates as it reenters earth's atmosphere, killing all seven crew members.

Feb 2: Crippling general strike ends in Venezuela.

Feb 3: President Bush sends Congress fiscal 2004 budget, proposing to bring federal outlays up to $2.23 trillion and incur record deficits in coming years.

Feb 11: Alan Greenspan tells Congress that the economy may not need a stimulus and warns that deficits predicted under Bush's stimulus package could hurt the economy in the long term.

Feb 19: Seven states file suit against the EPA for not regulating carbon dioxide emissions under the Clean Air Act.

March 6: The European Central Bank cuts interest rates (by a quarter percentage point) for the first time in three months.

March 19: World Health Organization calls Asian virus severe acute respiratory syndrome (SARS) and declares it to be a “worldwide health threat.”

March 20: The Iraq war begins as the U.S. launches Operation Iraqi Freedom.

April 9: The IMF releases its spring "World Economic Outlook," projecting a slight increase in real GDP growth for the European Union (from 0.8% in 2002 to 1.1% in 2003) and a slight decrease for the United States (from 2.4% in 2002 to 2.2% in 2003).

April 12: The SARS genome is decoded by scientists at the British Columbia Cancer Agency.

April 15: South Africa agrees to pay families of apartheid victims $3,900 each. Reparations will total $85 million.

April 16: Leaders of ten nations meet at the Acropolis in Athens, Greece, and sign treaties to join the European Union.

April 22: President Bush renominates Alan Greenspan to a fifth consecutive term as Chairman of the Federal Reserve Board.

April 28: Ten Wall Street investment firms settle with U.S. and agree to pay $1.4 billion fine for releasing dubious research reports to investors.

May 1: Iraq war "officially" ends as President Bush says combat over in Iraq.

May 1: A 6.4 magnitude earthquake hits southeastern Turkey, destroys a bridge and dozens of buildings, and kills more than 100 people.

May 2: The EPA reports fuel economy of the nation's cars and trucks averaged 20.4 miles a gallon in 2002, the lowest rate since 1980.

May 13: Public workers strike in France to protest proposed pension reform plan.

May 13: The U.S.Treasury introduces a new $20 bill design to thwart counterfeiting. The new bill will debut in the fall.

May 19: MCI telecommunications company (formerly WorldCom) agrees to pay $500 million fine to settle accusations of fraud.

May 20: Mad cow disease is discovered in Canada. U.S. bans imports of Canadian beef, cattle, and animal feed.

May 21: A 6.8 magnitude earthquake devastates Algeria, killing more than 2,250 people and injuring approximately 10,000.

May 28: President Bush signs a 10-year $350 billion tax cut package, the third largest tax cut in U.S. history. It temporarily eliminates dividend taxes, reduces capitals gains taxes, and increases child credit for most taxpayers.

May 29: Researchers clone a mule, named Idaho Gem, from a cell from a mule fetus and a horse egg.

May 29: Microsoft agrees to pay $750 million to AOL to settle an antitrust suit filed by Netscape, a division of AOL.

June 1: Heads of state discuss world economic and political issues at the annual G-8 summit.

June 8: Poland approves entry into the European Union.

June 9: Britain decides against adopting the euro.

June 10: Another robot (named Spirit) is launched to Mars to analyze samples of the red planet's geologic composition.

June 12: The European Union completes draft of a constitution that will give EU laws precedence over individual member nations'.

June 13: The state of Maine approves a universal health care plan that will offer low-cost coverage to all residents by 2009.

June 14: The Czech Republic votes to join the European Union.

June 25: The Federal Reserve cuts short-term interest rates again by a quarter of a point, bringing rates to their lowest level since 1958.

June 27: The FTC creates a Do-Not-Call registry. Beginning in October, telemarketers are prohibited from calling numbers on the list.

June 29: German Chancellor Gerhard Schroeder announces a plan to bring forward tax cuts worth about €18bn in an attempt to inject new life into Europe’s largest economy.

July 1: The U.S. withholds aid to 35 countries that did not give U.S. exemption to prosecution by the new International Criminal Court.

July 3: The U.S. Labor Department reports the jobless rate increased to 6.4% in June, the highest rate in nine years.

July 5: SARS is declared under control by the World Health Organization.

July 15: White House predicts current year's deficit to reach $455 billion, or 4.2% of the total economy.

July 28: J. P. Morgan Chase and Citigroup agree to pay nearly $300 million in fines for helping Enron to report misleading information in its financial reports.

Aug 12: A computer virus, called the Blaster worm, wreaks havoc with about 500,000 computers running recent versions of Microsoft Windows operating systems.

Aug 14: The largest power failure in U.S. history darkens the northeast and midwest for 29 hours, affecting 50 million people in eight states and parts of Canada.

August 15: Libya agrees to pay $2.7 billion to the families of the victims of the 1988 attack of Pan Am flight 103 that killed 270 people over Scotland.

Aug 26: The Congressional Budget Office predicts a federal deficit of $480 billion in 2004 and a cumulative total of $5.8 trillion by 2013.

Aug 27: The Bush administration relaxes environmental rules to allow power plants and refineries to upgrade systems without improving pollution controls and without violating the Clean Air Act.

Aug 29: Heat wave in Europe causes more than 11,000 deaths in France alone.

Sept 1: U.S. Treasury Secretary John Snow urges China to devalue the yuan.

Sept 3: The Census Bureau reports the number of U.S. residents who were born in other countries grew to more than 33 million in 2002, a 5% rise from 2001.

Sept 13: The IMF releases its fall "World Economic Outlook," projecting a slight decrease in real GDP growth for the European Union (from 0.9% in 2002 to 0.5% in 2003) and a slight increase for the United States (from 2.4% in 2002 to 2.6% in 2003).

Sept 14: Sweden decides against adopting the euro.

Sept 14: The WTO's Doha Round of world trade talks collapse in Cancún when representatives from developing nations walk out after rejecting a compromise on farm subsidies proposed by wealthier nations.

Sept 24: Citing a weak world economy, OPEC announces that it will reduce oil output by 3.5% on Nov. 1.

Sept 26: The U.S. Census Bureau reports the poverty rate increased to 12.1% in 2002, up from 11.7% in 2001.

Oct 15: China sends its first astronaut into orbit, becoming the third country (after the U.S. and Russia) to send a man in space.

Oct 23: Chinese President Hu Jintao tells Asia-Pacific business leaders that China will keep the yuan exchange rate stable.

Oct 24: At a donor conference in Madrid, countries and groups commit to donate about $13 billion over 5 years for reconstruction of Iraq.

Oct 27: President Bush declares California wildfires a disaster. The fires destroyed more than 500,000 acres and more than 1,000 homes and killed at least 17.

Oct 31: Figures released by the U.S. Department of Commerce show 7.2% GDP growth in the third quarter -- the fastest rate of expansion since 1984.

Nov 10: The WTO Rules against U.S. steel tariffs, clearing the way for other nations to impose retaliatory tariffs on imports from the United States.

Dec 4: President Bush rescinds U.S. tariffs on imported steel.

Dec 8: President Bush signs into law the largest overhaul of the Medicare system since it was established in 1965. The plan, costing an estimated $400 billion, provides the elderly with prescription drug coverage beginning in 2006.

Dec 11: The Dow Jones index of stock prices closes at 10,008.16, an 18-month high.

Dec 23: Forbes magazine readers pick white collar offshore outsourcing to be the most significant trend of 2003.

Dec 24: One Euro is worth US $1.24 in the world's foreign exchange markets, an appreciation of US 21 cents since the beginning of the year.

Primary Source for Timeline: http://www.infoplease.com

Event Number 1 The steady, relentless, and almost orderly depreciation of the U.S. dollar relative to the euro and several other key currencies is probably the most eventful trend of the year. At the beginning of the year one U.S. dollar was worth 0.964948 euro. At the end of the year it exchanges for only 0.803000 euro. The euro has appreciated by 21 U.S. cents and nearly the same per cent. This dynamic will put into motion a series of important effects in the months, if not years, ahead.

When a nation's currency depreciates, at least, 3 things begin to happen: 1. The nation exports more and imports less, because its goods and services are cheaper to foreigners and foreign goods and services are more expensive to its citizens. 2. Higher exports and lower imports have an expansionary effect on the domestic economy, creating more jobs. 3. On the other hand, the nation's terms of trade deteriorate. People in the United States will now have to work more hours to buy something from Europe. When a nation's currency appreciates, the opposites occur. The strong euro will retard exports and boost imports. Europe's economy will contract, but a European worker can buy more American goods with an hour's worth of pay than before.

Many economists had been predicting the dollar's ultimate depreciation given the U.S. chronic trade deficit. That creates a surplus of dollars in foreign exchange markets and puts downward pressure on the dollar. However, over half of that deficit is accounted for by Japan and China; and the dollar has hardly moved at all against the yen and the yuan. China has pegged 8.275 yuan to one U.S. dollar and intervenes to hold that exchange rate. Japan ostensibly lets the yen float in foreign exchange markets but frequently intervenes to keep the yen from appreciating. A significant reduction in the U.S. trade deficit is not likely to occur unless and until Japan and China cut their currencies loose and let them float freely.

Some economists have suggested that the dollar's depreciation against the euro is timely and potentially beneficial to both countries. It will help to improve the U.S. trade deficit, and it permits the European Central Bank (ECB) to lower interest rates further. The Bank has been reluctant to lower interest rates in spite of its sluggish economy out of fears of inflation. An appreciating euro is deflationary and opens the door for a more expansionary monetary policy in the Euro Area.

Event Number 2 Apparently, a strong currency is not always indicative of a strong economy. The Euro Area's economic slump is picked as the second most important event of the year. The Euro Area has demonstrated far less economic resilience than expected. Altogether, its 12 economies are projected to record a 0.5 per cent growth rate this year. Both the Netherlands and Portugal are in decline. Germany will not have grown at all. France's GDP might increase by 0.5 per cent. Even Ireland's rate of growth has slowed to 1.0 per cent compared to 6.9 per cent last year. Meanwhile, the average unemployment rate for the Euro Area has climbed to 9.1 per cent from 8.4 per cent last year. The image below presents the relatively poor macroeconomic performance of these countries in 2003 on the playing field of The Global Economics Game.

[Editor's note: When an economy's flag moves from left to right on the playing field, it indicates accelerating growth. When it moves from right to left, it indicates an economic slowdown or recession. Cyclical unemployment increases when an economy's production slows down or declines. Moving up the playing field indicates inflation. Moving down the playing field indicates disinflation or deflation. The numbers in the playing field show a country's score as it attempts to balance growth, pollution, inflation, and unemployment. Black numbers are positive; red numbers are negative. The objective is to land in or near the center square. The worst possible locations for an economy to be are in the corners of the playing field. The placements of the countries on the playing field based on IMF statistics and The Economist's consensus forecasts are only approximations.]

Source of Data: IMF. World Economic Outlook

(September

2003)

The most alarming aspect of this poor economic performance is that it may be more than merely a cyclical phenomenon. That is, the problem might require more than getting Europeans to spend and invest more. Instead, the Euro Area may have structural and institutional problems that are secular and longer term in effect. They are in the midst of undertaking a grand experiment of monumental proportion, and it may not work as smoothly as hoped for. It won't be easy to unravel the quilt of entitlements, balance the fiscal priorities, and set a monetary policy that is simultaneously appropriate for all the members. Adding more member countries in the years ahead will make the task even more difficult. Some economists are already predicting the ultimate demise of Europe's monetary union. These economies represent nearly one-fifth of the world's GDP. If they are in trouble, then so is the rest of the world.

Event Number 3 The rebound of the world's equity markets. Last year investors were lamenting their decision to hold stocks instead of bonds, gold or real estate. They had seen nearly one-third of their wealth evaporate in a 2 year bear stock market. Nobody jumped out of high rise windows, but there was a depressing mood on Wall Street. Corporate scandals and fears of deflation were like honey to the bears.

What a difference a year makes. This year equity markets around the world have rebounded. The bulls are back, and the bears are hibernating. The U.S. NASDAQ is up 42.6 per cent from the beginning of the year! Germany's DAX is up 32.1%! Even Japan's Nikkei is up 15.5 per cent.

Although not always reliable, stock prices are looked upon as a leading economic indicator. When stock prices rise, the economy's rate of growth tends to speed up soon thereafter. When stock prices fall, the economy tends to slow down after a short interval of time. The reason for this direct relationship between stock prices and the economy is what economists call the wealth effect. When equities go up in value, investors are richer. When households have more wealth, they tend to spend more. When equities go down in value, investors are poorer. When households have less wealth, they tend to spend less. The reason this relationship between the stock market and the economy is not always reliable is that there are many other variables besides the stock market that affect the overall economy. Still, this year's rise in stock prices is a very good omen for next year's global economy.

Event Number 4 The Iraq war and its effect on oil prices. While political in nature, the blustering between President George Bush and Saddam Hussein over weapons inspections had created an atmosphere of uncertainty around the world. This was most apparent in the world's petroleum market. The events leading up to war itself had driven crude oil prices up to nearly US $40 per barrel. Prices reached a two year high in February 2003.

The

prospects of another bout with global stagflation began to look

increasingly more probable. Higher oil prices cause a decrease in

aggregate supply, resulting in a combination of falling output and

higher

inflation. The world experienced this phenomenon in the 1970s and

early 1980s.

However, the quick and decisive end to the Iraq war resulted in sharply falling oil prices. The U.S. launched Operation Iraqi Freedom on March 20, and by the end of April the war was over. During the war oil prices fell sharply to $28 per barrel and have fluctuated between $28 and $31 per barrel since the end of the war. Another bout with stagflation had been avoided. In late September OPEC announced plans to cut oil production by 3.5%, citing a weak global economy as its justification. In spite of this cutback, oil prices were still below $30 per barrel at the year's end.

Event Number 5 The collapse of the world trade talks in September is selected as the fifth most significant economic event of 2003. Multilateral trade negotiations under the Doha Round had begun in early 2002 at the World Trade Organization (WTO) in Geneva. This year's meeting in Cancún had begun on a positive note when a compromise agreement regarding the distribution of pharmaceuticals in poor countries was reached early in the talks. However, as the issue of rich nation farm subsidies became the focus of the negotiations, tensions and tempers began to rise. Before any agreement could be reached, the poor nations walked out and the talks concluded on a sour note.

Rich countries (the U.S., the EU, and Japan) spend over $300 billion annually subsidizing their farmers. That's more than six times the amount they contribute to foreign aid. Poor countries cannot afford to subsidize their farmers anywhere near to that amount. So their farmers are left to compete in a global market against subsidized farmers in the wealthy countries. In effect, rich taxpayers are subsidizing relatively rich farmers in the industrialized advanced countries (IACs) at the expense of relatively poor farmers in the world's developing countries (DCs). Most people, especially in the DCs, consider this to be unfair; and that's why the WTO has been attempting to broker the issue.

The effect of rich nation agricultural subsidies on less developed countries is illustrated analytically in the diagram below.

If rich countries did not subsidize their farmers, the world price of agricultural products would be P2. Rich countries would produce Q1 of the world's food, and poor countries would produce from Q1 to Q3. Agricultural subsidies in the rich countries increases their supply of food products. After the subsidies, rich countries produce Q2 and poor countries are left to supply from Q2 to Q3. The yellow area (a + b) is the amount of subsidy paid by taxpayers in rich countries. The gray area (c) is the amount of revenue and export earnings lost by the poor countries as a direct result of the rich nation subsidies.

Event

Number 6 The rise and fall of U.S steel

tariffs..

The Bush administration had raised U.S. steel tariffs last year under

the

authority of Section 201 of the Trade Act of 1974, which authorizes the

President to take action when a particular product is being imported

into

the country in such large quantities as to cause injury or threaten

serious

injury to a domestic industry. This authority can be used even if

the import is not priced unfairly.

The European Union, Brazil, China, Japan, New Zealand, Norway, South Korea, and Switzerland filed a protest against the U.S. steel tariffs; and in November of this year the WTO ruled against the U.S., citing the steel tariffs to be a violation of international trade rules. The ruling authorized the other countries to impose retaliatory tariffs on U.S. products. The possibility of an international trade war was averted when President Bush rescinded the steel tariffs in early December.

As advocates of trade liberalization, most economists would probably applaud President Bush's decision. The steel tariffs had been a hypocritical embarrassment to the administration which had advocated freer trade around the world. Economically, higher tariffs inevitably cost consumers more than they benefit the protected industry. And if a global trade war had ensued, everybody would have lost.

Event Number 7 The severe acute respiratory syndrome (SARS) epidemic.. This was a new lethal strain of the Asian flu, and the speed to which modern medical scientists were able to decode its genome and contain the spread of the illness is a modern marvel. The epidemic first appeared in November of last year in the Guangdong Province, China. The illness peaked in April of this year and was declared in control by the World Health Organization in early July. This timeline is a sharp contrast to the 1918 influenza epidemic that spread so far so fast and lasted for so long that it killed more than 20 million people worldwide. The economic effects of SARS were limited primarily to its impact on the travel and tourism industry, especially in China and other countries in Asia.

Event Number 8 The Free Trade Agreement of the Americas (FTAA). The FTAA is an expansion of the North American Free Trade Agreement (NAFTA) to every country in Central America, South America and the Caribbean, except Cuba. The 34 participating countries began negotiations right after the completion of NAFTA in 1994 and plan to have a final agreement by 2005. If they are successful, it will be the most far reaching trade agreement in history.

This year's FTAA summit was in held in Miami, Florida in November. The usual anti globalization suspects were at the site to protest the agreement, arguing that it will undermine workers' rights, cause a loss of jobs, and do further damage to the environment. Inside, however, the trade ministers were able to reach an accord that will further the progress of the agreement. The FTAA faces many of the same issues that have proven almost insurmountable in the WTO. But nobody walked out of the Miami talks. That non-event is considered to be progress considering what happened at the WTO's trade talks in September.

Event Number 9 Britain rejects the eruo. This was probably the most eventful non-event of 2003. We refer to this as a non-event, because nothing changed as a result of the U.K.'s decision in June to stay with its British pound and not adopt the euro as the nation's official unit of currency. England's Chancellor of the Exchequer was probably right when he said that the country had not met certain economic conditions required before changing its currency. The U.K.'s history with joining international monetary arrangements is mixed at best. It had to devalue the pound several times under the Bretton Woods agreement after W.W.II. And its membership in Europe's exchange rate mechanism (ERM) in the early 1990s was short-lived. By choosing to not adopt the euro, Britain probably saved Europe from a lot of potential economic turmoil while maintaining its monetary sovereignty.

Event Number 10 Outsourcing IT jobs. The strategic decision on the part of multinational corporations (MNCs) to outsource tasks to the lowest cost provider around the world is not new. The new wrinkle is the outsourcing of relatively high paying information technology (IT) and software engineering jobs to India, Russia, the Philippines, Ireland, Israel, and China. Last year IT outsourcing to India represented 27 per cent of the country's export earnings. In December of this year Forbes magazine's readers selected white collar offshore outsourcing to be the most significant trend of 2003.

It was only a matter of time before the U.S. and other industrialized countries began to lose some IT jobs to lesser developed countries. That is the dynamic nature of comparative advantage and product life cycles. The innovator has a competitive edge at the beginning of the cycle; but as the knowledge spreads, others are able to perform the task as efficiently at lower wage rates. Eventually the originator loses the comparative advantage. We have seen this cycle historically with manufactured products such as radios, pocket calculators, and computers. Now it is happening in the more standardized software engineering services.

*******************

Economists are notorious for their disagreements. They will even disagree about whether they agree on something or not. So, not all economists will agree with this list of the 10 most significant economic events of 2003. We are all free to disagree and make up lists of our own. After all, that's half the fun.

Happy New Year!