September

2, 2000 This month thousands of students will begin attending

economics

classes at high schools, colleges, and universities around the

world.

For some of these students it will be the first time they have ever

been

exposed to the rigors of formal economics instruction. They will

likely be enrolled in Economics 101 -- Principles of Economics.

Others

will be in their second or higher year of course work. Those

students

will be taking upper division theory and advanced courses in various

fields

of specialization such as money and banking, international trade and

finance,

and environmental economics. A much smaller number of students

will

have made it to graduate school in economics, business, or

international

relations. Some of those students will be teaching assistants

(helping

younger students learn the principles) or research assistants (helping

their professors with publishing projects).

September

2, 2000 This month thousands of students will begin attending

economics

classes at high schools, colleges, and universities around the

world.

For some of these students it will be the first time they have ever

been

exposed to the rigors of formal economics instruction. They will

likely be enrolled in Economics 101 -- Principles of Economics.

Others

will be in their second or higher year of course work. Those

students

will be taking upper division theory and advanced courses in various

fields

of specialization such as money and banking, international trade and

finance,

and environmental economics. A much smaller number of students

will

have made it to graduate school in economics, business, or

international

relations. Some of those students will be teaching assistants

(helping

younger students learn the principles) or research assistants (helping

their professors with publishing projects).

Economics has recently become a more common major of study among

college

students. Two years ago The Wall Street Journal published

Tristan Mabry's article focusing on the growing popularity of economics

at leading colleges and universities in the United States.

According

to the article, "The dismal science is in vogue again on

campus.

After years of trailing history, English and biology as the top

undergraduate

major, economics is enjoying a surge in popularity with college

students,

especially at the nation's most elite institutions. Economics,

once

considered one of the more difficult subjects to grasp, is the top

major

at Harvard, Princeton, Columbia, Stanford and the Universities of

Pennsylvania

and Chicago; second at Brown, Yale and the University of California at

Berkeley; and third at Cornell and Dartmouth."

What accounts for the increasing interest in a discipline that is

notorious

for causing anxiety, depression, and nausea with its bewildering maze

of

analytical axioms, esoteric blends of science and philosophy, and heavy

reliance of quantitative methods? According to the article, one

reason

appears to be global prosperity. Contemporary students are

focused

on their careers. They rank a good job and high future income as

the main reasons for attending college; and they perceive

economics

to be a good vehicle toward those ends. When Main Streets and

Wall

Streets around the world are thriving, globally oriented companies hire

more economists. The average starting salary for graduating

economics

majors at one of these companies is just over US $35,000. That

figure

is higher than most other undergraduate majors, and starting salaries

are

higher for those with Masters degrees and Ph.D.'s.

Economics is also perceived as an excellent undergraduate major for

someone pursuing a post-graduate law degree. "Of all the majors,

economics ranks in the top four or five consistently year after year

for

both applicants and offers made," said Edward Tom, director of

admissions

at the University of California at Berkeley's Boalt law school, to the

Journal's

reporter Mabry. "Logical reasoning and analytical skills are

critical

to legal studies," added Tom. Not surprisingly, economics majors

average the highest ranking score of 155 out of a possible 180 on the

Law

School Admissions Test (LSAT).

Another more subtle reason for the growing popularity of economics

is

the end of the Cold War. "Now that the Cold War is over," stated

Yale University Professor Merton Peck, "Economic issues become the

central

core of policy debates." Students are no longer focused on the

ideological

polemic of communism versus capitalism. These days they debate

the

efficacy of fixed versus variable exchange rate systems. Domestic

fiscal policy, government debt, the role of central banks, and trade

issues

are the main topics of discussion over coffee at university

cafeterias.

Also, environmental issues are very much on the minds of young people,

and economics has much to say about how to improve air and water

quality,

protect endangered species, and preserve wilderness regions.

A third reason that economics has become more popular among students

is that its importance and power to explain events is more commonly

understood

than it used to be. The famous British economist John Maynard

Keynes

is often quoted from his landmark book, The General Theory of

Employment,

Interest, and Money (1936): "The ideas of economists

and

political philosophers, both when they are right and when they are

wrong,

are more powerful than is commonly understood. Indeed, the world

is ruled by little else. Practical men, who believe themselves to

be quite exempt from any intellectual influences, are usually the

slaves

of some defunct economist." Sixty four years later the secret is

out. "Increasingly, economic issues are presented to citizens as

an important determinant of how their life is going to play out,"

Professor Michael K. Salemi, chairman of the economics department at

the

University of North Carolina, is quoted in The Wall Street Journal article.

Economics is now considered to be a core subject at most high

schools.

It's no longer a secret to young people that economic events and

policies

are powerful forces in shaping the course of human destiny.

Increasingly

more high school students have already taken some economics before they

enter college. For these reasons today's first year college

students

are less intimidated by economics than they are intrigued by it.

They have a genuine thirst to learn more about how the economy works

and

the institutions which monitor and strive to steer it.

The freshman or sophomore

students taking Economics 101 at colleges and

universities in the academic year 2000/2001 will be learning more about

the global economy than their predecessors. Greater

emphasis is being placed on the world economy, because global economic

integration has become an important determinant of the macroeconomic

performance

of nations. More and more nations around the world are

opening

their economies to international trade, diversifying their export base,

and attracting foreign investment. The foreign trade sector is

now

the fastest growing segment of most economies. Within any given

country,

the financial health of its companies and the job security of their

workers

are increasingly dependent upon foreign sources for inputs and foreign

sales for revenues. Consumers are purchasing imports and

traveling

internationally more than ever before.

The freshman or sophomore

students taking Economics 101 at colleges and

universities in the academic year 2000/2001 will be learning more about

the global economy than their predecessors. Greater

emphasis is being placed on the world economy, because global economic

integration has become an important determinant of the macroeconomic

performance

of nations. More and more nations around the world are

opening

their economies to international trade, diversifying their export base,

and attracting foreign investment. The foreign trade sector is

now

the fastest growing segment of most economies. Within any given

country,

the financial health of its companies and the job security of their

workers

are increasingly dependent upon foreign sources for inputs and foreign

sales for revenues. Consumers are purchasing imports and

traveling

internationally more than ever before.

According to Michael Mussa, Economic Counselor and Director of

Research

IMF, "Global economic integration is not a new phenomenon."

However,

"The degree of economic integration among different societies around

the

world has generally been rising. Indeed, during the past half

century,

the pace of economic globalization has been particularly rapid.

And,

with the exception of human migration, global economic integration

today

is greater than it ever has been and is likely to deepen going

forward."

In his paper presented on August 25 in Jackson Hole, Wyoming at the

international symposium on "Global Opportunities and Challenges," Mr.

Mussa

identified three fundamental factors that are driving economic

globalization

The first is cost reducing improvements in the technology of

transportation

and communication. Secondly, the tastes of individuals and

societies

have generally favored taking advantage of the opportunities provided

by

these declining costs. Third, public policies have significantly

influenced the character and pace of economic integration. Mussa

noted that during the past 50 years of remarkable economic growth,

"World

trade in goods and services has expanded at nearly double the pace of

world

real GDP. As a result the volume of world trade in goods and

services

(the sum of both exports and imports) rose from barely one-tenth of

world

GDP in 1950 to about one-third of world GDP in 2000. By this

measure

-- and by others as well -- there has indeed been an increase in the

degree

of global economic integration through trade in goods and services

during

the past half century."

Globalization is controversial. Not everyone views the growing

trend toward greater international economic integration as a positive

development.

Anti-globalists perceive international institutions such as the World

Trade

Organization, the International Monetary Fund, and the World Bank as

one-world

entities that place business priorities over human rights, labor

standards,

and environmental protection. Technologically driven

globalization

is an engine of growth and creates many new opportunities, but it

displaces

relatively inefficient firms and their workers in the process; and it

causes

environmental and social upheaval. These unintended consequences of

progress,

heightened global competition, and greater efficiency are at the crux

of

the controversy.

At the same symposium in Wyoming where Mr. Mussa presented his

paper,

Alan Greenspan, Chairman of the Federal Reserve Board of Governors,

addressed

the issue in his remarks: "Globalization as most economists

understand

it involves the increasing interaction of national economic

systems.

Of necessity, these systems are reasonably compatible and, in at least

some important respects, market oriented. Certainly,

market-directed

capitalism has become the paradigm for most of the world, as

central-planning

regimes have fallen into disfavor since their undisputed failures

around

the world in the four decades following World War II. But there

remains

an active intellectual debate over the elements of capitalism that are

perceived as most essential for a productive and civil society. . . .

.

The conceptual battleground has moved far from the stark terms of the

earlier

capitalist-socialist confrontations. . . . . The debate has now

shifted

to the nature and extent of actions appropriate for governments to take

in order to ameliorate some of the less desirable characteristics that

are perceived to accompany unfettered competition."

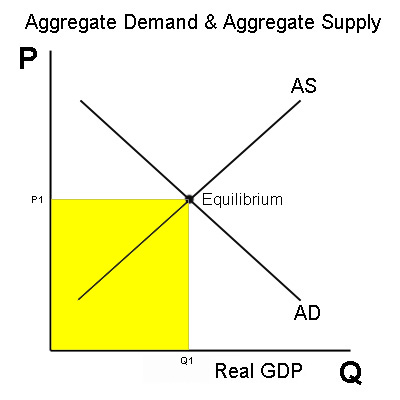

This year's crop of Economics 101 students will have the opportunity

to participate in this emerging debate for the new millennium.

The

key analytical model they will use to analyze the performance of market

oriented economies in a global context is that of Aggregate Demand and

Aggregate Supply. The AD-AS model is included as one or more

chapters

in virtually every leading introductory textbook. It is displayed

by a diagram which measures a given country's price level on the

vertical

axis and real GDP on the horizontal axis. Aggregate Demand (AD)

is

comprised of consumer spending, business investment, government

purchases,

and net exports; it is inversely related to the general price

level.

Simply put, people will buy more quantity (Q) at lower prices (P), all

other things held constant. Aggregate Supply (AS), on the other

hand,

is directly related to the general price level. Simply

put,

business firms will supply more at higher prices. (See Diagram Below).

Market oriented economies will naturally seek the equilibrium level

of output and prices (where the AD and AS lines cross). Nominal

GDP

(P1xQ1) is shown by the yellow shaded area. If AD were to

increase

(or decrease), the AD curve would shift outward (or inward).

Nominal

GDP would rise (and fall) accordingly. So would the real GDP, but

not by as much because real GDP measures output at constant (base year)

prices. Fiscal, trade, and monetary polices are used by

governments

on the margin to find an acceptable level of real GDP near full

employment

without too much inflation or too much pollution. This becomes

more

apparent when we superimpose the AD-AS model on the playing field of The

Global Economics Game.

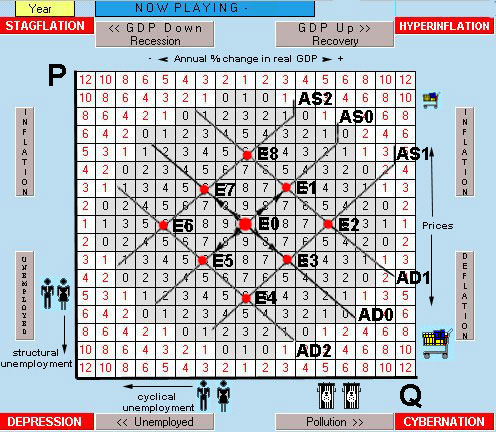

The image above displays the AD-AS model superimposed on the playing

field of The Global Economics Game. Each square in

the playing field represents a given country's macroeconomic

performance.

Moving from left to right indicates faster economic growth.

Moving

up the playing field indicates higher prices. Cyclical

unemployment

rises and falls inversely with growth; when GDP increases, cyclical

unemployment

falls and vice versa. However, structural unemployment can be

caused

by increases in aggregate supply (from AS0 to AS1); and excessive

unbridled

growth can cause too much pollution (E2). Because economics

involves

trade-offs and conflicting goals, economic policy is constantly

striving

for an optimal mix of output, unemployment, prices, and

pollution.

That optimal mix is assumed to be the very center square of the playing

field (E0). Moving away from the center square results in lower

scores.

The red numbered zones in the corners indicate negative scores and are

highly undesirable.

For example, contrived commodity shortages, natural disasters, and

labor

strikes can reduce Aggregate Supply (from AS0 to AS2) so that an

economy

would move from E0 to E7 toward stagflation. On the other

hand, cost saving technological breakthroughs and greater competition

from

freer trade have the effect of increasing AS so that an economy would

move

toward E3 and the cybernation corner. A deficiency in

Aggregate

Demand (AD) would drive an economy in the direction of E5 and depression

in the lower left corner. Excessive AD would move an economy in

the

opposite direction diagonally toward E1 and hyperinflation in

the

upper right corner.

Returning to the issue of globalization, the trade-offs are apparent

from the playing field's matrix. The benefits derived from

technologically

driven globalization are lower prices, more output, and greater

efficiency.

[An economy moves diagonally downward toward the lower right corner of

the playing field]. However, the costs are structurally displaced

workers, the social disharmony caused by greater income inequality, and

the damage done to the environment where external costs are unaccounted

for. If the public perceives that the economy is moving too far

diagonally

down or too rapidly to the right on the playing field, then they will

call

for public policy measures to reverse the trend. Trade

restrictions

and environmental regulations can be used to do this. Economics

101

teaches that it makes more sense to subsidize and re-train workers who

have been displaced by market driven changing patterns of trade.

However, it also teaches that it makes perfectly good sense to use supply-side

regulatory policies to thwart growth if its costs to the environment

are

exceeding its benefits on the margin. (Technically, this is

called

internalizing an externality). The objective is to equate

marginal

benefit and marginal cost.

The marginal benefit equal to marginal cost principle also applies

to

demand-side

macroeconomic policy. Students taking Economics 101 this year

will

begin to understand why central banks in the industrialized world have

recently been using monetary policy to tighten credit and raise

interest

rates (See Table Below). The perceived enemy is potential future

inflation. Strong aggregate demand can generate economic

expansion,

but excessive aggregate demand can cause inflation. When central

bank policy makers are convinced that the costs of future inflation

will

exceed the benefits of cyclical expansion, they will implement a

restrictive monetary policy to curtail aggregate demand. Higher

interest

rates make it more difficult for consumers and businesses to borrow and

spend.

Interest Rates: 3-month money market (annual

percent)

|

Country

|

08/23/00

|

Year Ago

|

Australia Australia |

6.53

|

4.93

|

Britain

Britain |

6.11

|

5.22

|

Canada Canada |

5.62

|

4.69

|

Denmark Denmark |

5.70

|

3.10

|

Japan Japan |

0.30

|

0.03

|

Sweden Sweden |

3.92

|

3.04

|

Switzerland Switzerland |

3.48

|

1.12

|

United States United States |

6.50

|

5.30

|

E-11

E-11 |

5.04

|

2.59

|

Source: The Economist (August 26th -

September

1st 2000)

Market oriented economies are notorious for their unpredictability,

instability, and cyclical fluctuations. The myriad of forces

driving

aggregate demand and aggregate supply are constantly in flux.

Well

intended macroeconomic policy measures run the risk of being ill-timed

-- either too little and too late or too much and too soon. An

overly

restrictive monetary policy, for example, has the potential to

precipitate

a recession. Increased globalization adds still another dimension

of uncertainty to the equation. Monitoring

the macroeconomic performance of nations, evaluating the soundness of

fiscal,

trade, and monetary policies, and balancing conflicting goals in a

global

setting are the core topics of modern economics that will mystify and

engage

this year's students.

It is indeed a fascinating subject. Those of us who have

chosen

economics for our careers never seem to become bored by it,

because

it perpetually addresses the most important social, business, and

personal

issues of the day. In that sense Economics 101 doesn't change

over

time -- only the issues do. Most of the students taking Economics

101 in the year 2000 will derive a great deal of benefit from the

experience.

Even though it will cost them time and money, the most important

economic axiom they will learn is that anything is worth doing if the

benefits

exceed or are equal to the costs.

Sources and Recommended Links:

Mabry, Tristan. "Economics Enjoys a Bull Run at Colleges." (The

Wall

Street Journal, November 30, 1998).

Mussa,

Michael. "Factors Driving Global Economic Integration." August 25, 2000)

The

Federal Reserve Board. "Remarks by Chairman Alan Greenspan." (August

25,

2000)

Return

to Home Page Return

to World Economics News

The Global Economics Game (C)

2000

Ronald W. Schuelke All Rights Reserved

The freshman or sophomore

students taking Economics 101 at colleges and

universities in the academic year 2000/2001 will be learning more about

the global economy than their predecessors. Greater

emphasis is being placed on the world economy, because global economic

integration has become an important determinant of the macroeconomic

performance

of nations. More and more nations around the world are

opening

their economies to international trade, diversifying their export base,

and attracting foreign investment. The foreign trade sector is

now

the fastest growing segment of most economies. Within any given

country,

the financial health of its companies and the job security of their

workers

are increasingly dependent upon foreign sources for inputs and foreign

sales for revenues. Consumers are purchasing imports and

traveling

internationally more than ever before.

The freshman or sophomore

students taking Economics 101 at colleges and

universities in the academic year 2000/2001 will be learning more about

the global economy than their predecessors. Greater

emphasis is being placed on the world economy, because global economic

integration has become an important determinant of the macroeconomic

performance

of nations. More and more nations around the world are

opening

their economies to international trade, diversifying their export base,

and attracting foreign investment. The foreign trade sector is

now

the fastest growing segment of most economies. Within any given

country,

the financial health of its companies and the job security of their

workers

are increasingly dependent upon foreign sources for inputs and foreign

sales for revenues. Consumers are purchasing imports and

traveling

internationally more than ever before.

September

2, 2000 This month thousands of students will begin attending

economics

classes at high schools, colleges, and universities around the

world.

For some of these students it will be the first time they have ever

been

exposed to the rigors of formal economics instruction. They will

likely be enrolled in Economics 101 -- Principles of Economics.

Others

will be in their second or higher year of course work. Those

students

will be taking upper division theory and advanced courses in various

fields

of specialization such as money and banking, international trade and

finance,

and environmental economics. A much smaller number of students

will

have made it to graduate school in economics, business, or

international

relations. Some of those students will be teaching assistants

(helping

younger students learn the principles) or research assistants (helping

their professors with publishing projects).

September

2, 2000 This month thousands of students will begin attending

economics

classes at high schools, colleges, and universities around the

world.

For some of these students it will be the first time they have ever

been

exposed to the rigors of formal economics instruction. They will

likely be enrolled in Economics 101 -- Principles of Economics.

Others

will be in their second or higher year of course work. Those

students

will be taking upper division theory and advanced courses in various

fields

of specialization such as money and banking, international trade and

finance,

and environmental economics. A much smaller number of students

will

have made it to graduate school in economics, business, or

international

relations. Some of those students will be teaching assistants

(helping

younger students learn the principles) or research assistants (helping

their professors with publishing projects).