December

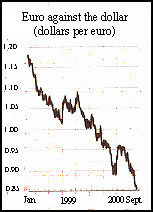

10, 2000 The euro had been rolling down hill in currency markets

since it was introduced at $1.17 in January of 1999. When its

decline

reached $0.85 in late September of this year, five of the world's major

central banks coordinated a market intervention to halt the euro's

downward

slide. On Friday, September 22 the European Central Bank

(ECB),

the Federal Reserve Bank of the United States, the Bank of England, the

Bank of Japan, and the Bank of Canada began to purchase euros with

approximately

2 billion reserve dollars. Arguably, the intervention has

worked.

At this writing the euro was exchanging for about $0.887.

December

10, 2000 The euro had been rolling down hill in currency markets

since it was introduced at $1.17 in January of 1999. When its

decline

reached $0.85 in late September of this year, five of the world's major

central banks coordinated a market intervention to halt the euro's

downward

slide. On Friday, September 22 the European Central Bank

(ECB),

the Federal Reserve Bank of the United States, the Bank of England, the

Bank of Japan, and the Bank of Canada began to purchase euros with

approximately

2 billion reserve dollars. Arguably, the intervention has

worked.

At this writing the euro was exchanging for about $0.887.

Several reasons have been cited to justify the central banks' intervention: (1) politically, there was concern that the falling value of the euro was undermining the image of the E-11 economies and their new monetary union; (2) any further decline in the euro combined with rising oil prices would cause inflation in Europe to rise to an unacceptable rate; (3) a falling euro and rising dollar would exacerbate the U.S. trade deficit and generate renewed calls for protectionism in the U.S.; and (4) the euro profits of U.S. companies operating in Europe were being adversely affected in terms of dollars by the declining euro.

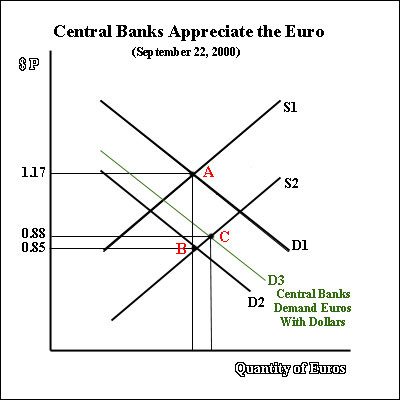

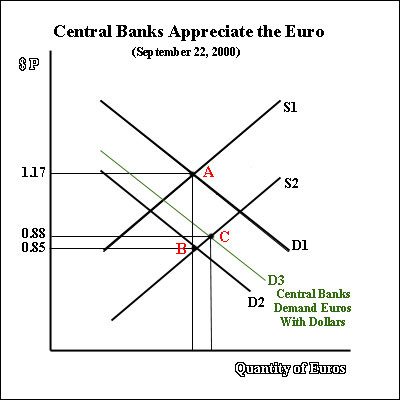

The five central banks used their reserves of dollars to purchase euros. The intervention simultaneously increased the supply of dollars (causing the dollar to depreciate) and increased the demand for euros (causing the euro to appreciate). The diagram below shows how central bank intervention could reverse the euro's fall.

(A) Europe introduces the euro to currency markets at $1.17 in January 1999. (B) Over time the euro falls to $0.85 near the end of September 2000. (C) On September 22, 2000 five central banks increase the demand for euros with dollar reserves, and the value of the euro rises to $0.88.

The euro depreciated from $1.17 to $0.85 because the supply of it [S1 - S2] exceeded the demand for it [D1 - D2]. As it depreciated, European goods and services became increasingly less expensive and more attractive to those who were holding dollars. This helped stimulate European exports and the European economies. However, it also contributed to inflation in Europe, because imports became more expensive. Furthermore, when a country's currency depreciates, its terms of trade deteriorate. That is, it must export more volume to finance a given volume of imports. The central bank intervention attempted to reverse these trends by appreciating the euro from $0.85 to $0.88 [D2 - D3].

Appreciation of the euro would have the adverse effect of slowing the European economies unless it is sterilized by a corresponding increase in the money supply. That is, when a country's currency appreciates, its exports become more expensive and less attractive to foreigners. When exports decline (and imports increase) net exports diminish and contribute to economic contraction. This adverse effect can be neutralized or sterilized by a corresponding increase in the money supply to reduce interest rates and stimulate the economy. From all accounts it appears that the European Central Bank (ECB) did indeed sterilize the currency intervention to preempt any economic slowdown that might otherwise be caused by the euro's appreciation.

A single central bank can manipulate its country's currency in foreign exchange markets, but only if other central banks do nothing to counteract the policy. Indeed, the policy is more likely to succeed if other central banks cooperate and support the intervention. In this case, the European Central Bank (ECB) was able to enlist the cooperation and coordination of four other major central banks. Some analysts were surprised by the willingness of the US Treasury to give the Federal Reserve System its authorization to support the intervention, because the US Treasury had previously indicated its commitment to a strong dollar. In the process of appreciating the euro, the dollar was depreciated. Apparently, the US Treasury calculated that early signs of an economic slowdown in the United States had lowered the inflationary risk of a depreciating dollar. Furthermore, a depreciating dollar would help to alleviate the United States' chronic deficit on its current account in the balance of payments. Similarly, Japanese officials indicated that their intervention was an effort to curb not only the dollar but also the yen's strength against the euro. A depreciating yen would help to stimulate the ailing Japanese economy. Thus, the timing of the intervention was uniquely acceptable to the other central banks. Michael Mussa, chief economist of the International Monetary Fund, remarked to a Financial Times reporter that the time was ripe for a coordinated intervention: "You have to ask: if not now, when?"

It

is arguable whether or not the five central banks were, in fact, able

to

reverse the euro's decline by leaning against the wind.

The

market had been bashing the euro for some time, and the five central

banks

attempted to reverse that trend by purchasing large amounts of euros

with

dollars. However, if the underlying trends that were initially

depreciating

the euro were to persist, then the euro depreciation in foreign

exchange

markets would merely resume after the intervention. Indeed, the

euro

did fall to $0.83 from $0.88 after the central bank

intervention

and then later returned to $0.88. So the question

is:

Did the intervention reverse the trend or did the underlying market

forces

independently reverse their course?

It

is arguable whether or not the five central banks were, in fact, able

to

reverse the euro's decline by leaning against the wind.

The

market had been bashing the euro for some time, and the five central

banks

attempted to reverse that trend by purchasing large amounts of euros

with

dollars. However, if the underlying trends that were initially

depreciating

the euro were to persist, then the euro depreciation in foreign

exchange

markets would merely resume after the intervention. Indeed, the

euro

did fall to $0.83 from $0.88 after the central bank

intervention

and then later returned to $0.88. So the question

is:

Did the intervention reverse the trend or did the underlying market

forces

independently reverse their course?

Europeans had been demanding a lot of dollars to make portfolio investments in the United States. That contributed to the depreciating euro. However, uncertainty over the US presidential election in November, signs of an economic slowdown in the United States, and declining equity values in US stock markets may have given Europeans pause and diminished their demand for dollars soon after the central bank intervention. If Europeans began curtailing their demand for dollars for these reasons, then the dollar would depreciate and the euro would appreciate because of market forces -- not because of central bank of intervention. The Financial Times reported on December 1, 2000 that "slowing growth and decelerated earnings in the United States appeared to have stopped the dollar's long bull run against the euro in its tracks."

Analyzing the cause-effect relationships of economic events and policies is a little like giving a cat a bath. It would be a lot easier if the cat held still. First year economics students are taught to use the ceteris paribus (all other things held constant) condition when performing economic analysis. However, the world does not hold still while the economist attempts to make sense of it. We know that the euro fell over time from $1.17 to $0.85. We also know that five central banks intervened on September 22, 2000 to reverse that trend. The euro subsequently rose to $0.88, fell to $0.83, and then rose again to $0.88 by December 10. What is not clear is whether the euro's decline was halted because of the deliberate central bank intervention in September or because of a reversal in fundamental market forces soon thereafter. Perhaps it was because of a combination of the two events.

Images are property of NV Tech

Sources and Recommended Links

Financial Times. (September 23 - December 10, 2000).

The Economist. (September 23 and September 30, 2000).

To get the latest foreign exchange quotations with a currency

converter,

visit the exchange rates page of this

web

site.