April

1999 The United States economy experienced perhaps the best year

in the history of the republic in 1998. The rate of economic growth was

nearly 4%. Unemployment fell to 4.5%, and inflation was below

2%.

It doesn't get much better. Americans are telling pollsters that

they feel better off than at any other time in their lives.

April

1999 The United States economy experienced perhaps the best year

in the history of the republic in 1998. The rate of economic growth was

nearly 4%. Unemployment fell to 4.5%, and inflation was below

2%.

It doesn't get much better. Americans are telling pollsters that

they feel better off than at any other time in their lives.

The confidence of the American consumer is holding up the global economy. Americans are buying goods from other countries at a record pace.

Economic policy is "steady as she goes." The federal budget

has

a modest surplus. The Federal Reserve System has adopted a "wait

and see" monetary policy, and the dollar remains strong against other

currencies.

The early outlook for 1999 is very favorable. The Dow Jones stock market index broke the 10,000 mark in late March. The unemployment rate fell further to its lowest level in decades, and inflation remained calm.

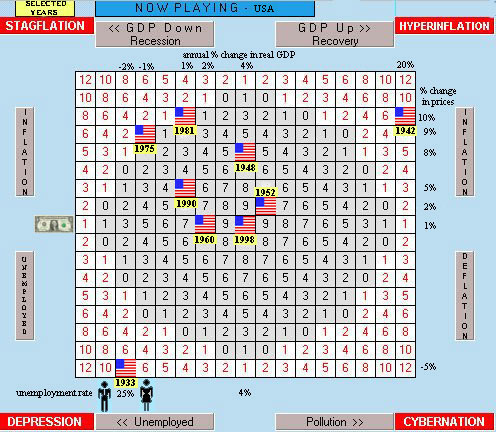

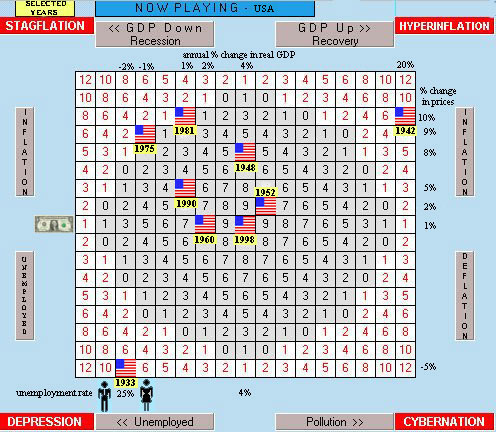

Americans should savor this prosperity. The economy does not always perform this well. (See picture and table below). History teaches that perfection is the exception -- not the rule.

When playing The World Game of Economics, it is difficult to land in the very center. Landing there in real life is even more difficult. It is a rare occurrence. While the United States economy has had many years of good economic performance, it has seldom been in optimal balance in terms of growth, pollution, unemployment, and inflation. The year 1998 is indeed an exceptional economic performance. At various times in its history, the US economy has been in depression, stagflation, and hyperinflation. It has even flirted with cybernation.

During the 1930's the US economy spent all of its time in the depression corner of the playing field. Unemployment peaked at 25% of the labor force. It was during this decade that the US began to abandon laissez faire economics. The government initiated many new entitlement programs and public works projects. However, the economy did not really get out of the Great Depression until World War II. Government spending for defense was over $50 billion annually from 1942-1945. That would be the equivalent of over $500 billion anually in 1998 dollars! Price controls were implemented during the war to contain inflation.

After the war, the US economy receded. During the 1950s and 1960s, the economy experienced converging cyclical fluctuations and performed reasonably well overall. However, in the 1970s and early 1980s the economy struggled with stagflation. Recession, combined with rising unemployment and inflation, were typical of this period. The dependency on imported oil, which experienced dramatic price increases, was a major cause of this poor overall economic performance. It was also during this period that strict environmental regulations were initiated to curtail pollution levels.

Following a brief recession in 1991, the US economy improved its overall economic performance steadily and deliberately throughout the remainder of the decade. It has been the longest sustained economic recovery on record. Unemployment has declined, and inflation seems subdued. As the world approaches the 21st century, the strength of the US economy is a major factor in the global economy.

Many economists have envisioned the demise of capitalism via the path of cybernation. Rapid technological change, capital intensive production, and fierce competition have always threatened the job security of workers. Robots have replaced workers on the assembly line, bookkeepers have been displaced by computer software, and free trade agreements have caused structural unemployment in less efficient industries. However, workers have proven to be remarkably resilient. Through retraining and the willingness to relocate, workers have found new jobs in sunrise and other industries. Whether or not the pace of change will ultimately result in widespread and persistent structural unemployment remains to be seen, but history suggests that the effects of cybernation are only temporary.

United States Economic History: Selected Years 1933 - 1998

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|