Accelerating

Inflation: Demand-Pull or Cost-Push?

The rate of inflation accelerated in 2004 in about half of the

countries depicted in Figure 1. This is not surprising, because

empirical research in economics indicates that inflation begins to

increase when an economy's recovery moves its output closer and closer

to its full-employment, potential GDP. It is called demand-pull

inflation. It is also not surprising that inflation is on the

rise in many countries, because oil prices also rose in 2004.

Higher oil prices can cause inflation, because oil is the world's

principal source of energy and production costs increase for many goods

and services when oil prices rise. This is called cost-push

inflation.

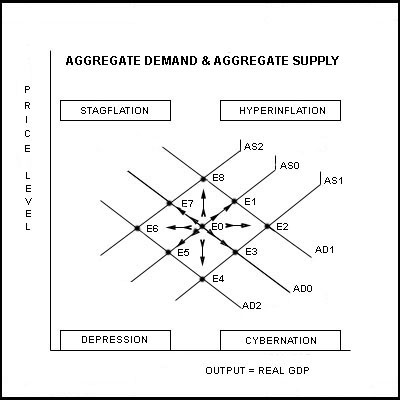

The analytical diagram in Figure 2 below depicting the model of

Aggregate Demand (AD) and Aggregate Supply (AS) can be used to see the

difference between demand-pull and cost-push inflation. If an economy

is initially at E5 in the diagram, then an increase in Aggregate Demand

(AD) from AD2 to AD0 would move the economy along the Aggregate

Supply (AS0) curve from E5 to E0. The country's real GDP would

increase, and prices would be

pulled

up by the increased demand. If the economy were

subsequently hit by an adverse oil price shock, then the AS curve would

shift from AS0 to AS2 and the economy would move from E0 to E7 along

the AD0 curve. The real GDP would contract, but prices would be

pushed up by the higher oil prices.

Figure

2

Higher oil prices in the mid-1970s caused severe global stagflation --

the combination of recession and inflation. Economies around the

globe were hurled from E0 toward E7 and beyond in Figure 2. In

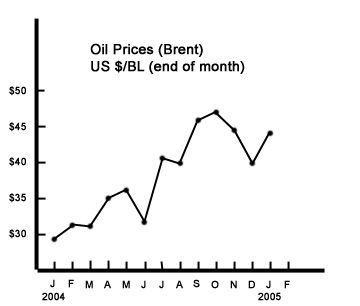

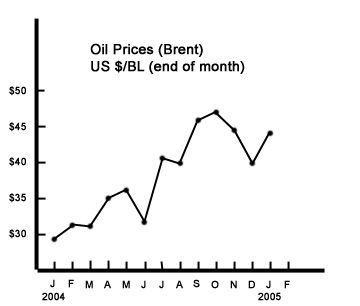

contrast, oil prices rose rather dramatically in 2004 (See Figure 3

below), but the adverse impact on output and prices was much smaller

than in the 1970s.

Figure

3

Source: U.S. National Energy Information Center

Source: U.S. National Energy Information Center

The adverse impact of higher oil prices in 2004 was less severe than in

the mid-1970s for several reasons: (1) Many economies are now less

dependent on oil as a per cent of total GDP than they were in the

1970s. This means they are less vulnerable to cost-push inflation

arising from an adverse oil supply shock. For example, oil

expenditures were about 10 per cent of United States GDP in the 1970s,

compared to only 3 per cent in 2004. (2) The percentage increases

in oil prices in the mid-1970s were very high, exceeding 100, 200, and

300 per cent. Today, an increase in the price of oil from $30 to

$50 is still only a 66 per cent increase. (3) The oil price

increases in the 1970s were not being offset by increases in

productivity in other sectors. Today, productivity increases are

being driven by information technology and globalization. (4) The

oil price increases in the mid-1970s caused aggregate supply to

decrease by more than any increases in aggregate demand. As a

result, not only did inflation increase, but output fell as well.

In 2004, it appears that increases in aggregate demand were the greater

force so that real GDP increased in spite of any decrease in aggregate

supply due to higher oil prices. This would explain why most

countries around the world grew so rapidly in 2004. Higher oil

prices failed to stall the global economic recovery in 2004.

The

Outlook for 2005

If oil prices were to go up again in 2005 at the same rate that they

did in 2004, say from US $45/bl to $60/bl, then they might begin to

have more severe adverse consequences on the global economy.

However, most analysts don't expect to see this happen. A more

likely development in 2005 is the probable rise in interest rates as

central banks around the world begin to fear accelerating inflation and

try to take the steam out of aggregate demand. When central

bankers expect higher and unacceptable rates of inflation, they try to

engineer "soft landings" with tighter money. Already, short-term

interest rates in the United States have gone up from 1 per cent a year

ago to 2.6 per cent today. It's a tricky assignment to cool down

an economy without going too far and causing a recession.

Return

to Home Page Return

to World Economics News

The Global Economics Game (C)

2000-2004

Ronald W. Schuelke All Rights Reserved

February 18, 2005 -- The initially

anemic global economic recovery from the 2001/02 recession really

picked up steam in 2004. Virtually every major economy in North

America, South America, Europe and Asia grew faster in 2004 than in

2003.

February 18, 2005 -- The initially

anemic global economic recovery from the 2001/02 recession really

picked up steam in 2004. Virtually every major economy in North

America, South America, Europe and Asia grew faster in 2004 than in

2003.