Anatomy of an Economy in Transition

The clockmaker's view of the universe shows everything revolving around the earth with Prague at the center. The clock keeps several versions of time: Old Bohemian, Modern Roman, and Babylonian. Arcing lines and moving spheres combine with the big hand (a sweeping golden sun) and the little hand (the moon) to indicate the times of sunrise and sunset. The orbits of the sun and the moon rotate through the day (the blue zone) and night (the black zone). Even by modern standards the clock endures as an amazing work of art, architecture, and mechanical engineering. It is a priceless national treasure.

Time has been both kind and cruel to the people of the Czech Republic. At the beginning of this century the territory was one of the most economically developed parts of Europe. Before World War II, it was considered to be among the ten most developed countries in the world. However, after the Second World War, it came under the Soviet sphere of influence and the victim of communist experimentation. The economy virtually stagnated for over forty years. The fall of communism in 1989 created an opportunity for economic reversal, and the country seized it. Today, the Czech Republic is a vibrant, growing Economy in Transition from socialism to capitalism, attracting visitors and investors from around the globe. Its capital city, Prague, which escaped bombing damage during World War II, is arguably the most beautiful city in the world.

Anatomy of an Economy in Transition

The transition from a closed, command oriented economic system to one that is opened to international trade and based on market activity is predictably and necessarily painful. In the former system, the government controls virtually all economic activity. Prices are set by the government. Investment and output are determined by central planning and controlled by government monopolies. Labor resources are allocated by government bureaucracy, and the national currency is non convertible. When an economy shifts to a free market orientation, price controls are removed, industries are privatized, government subsidies are gradually abated, labor becomes more mobile, trade is liberalized, and the currency becomes convertible. However, the inefficiencies of the former system make the transition difficult to accomplish. The people and the business institutions are not accustomed to global competition. The commercial sector must be revitalized, entrepreneurial skills must be nurtured, and new global markets must be captured.

The Czech Republic's economic transformation which began in the early 1990s was based upon 5 basic elements: (1) trade liberalization, (2) convertibility of the currency, (3) austerity in fiscal and monetary policies, (4) privatization of industry, and (5) tax reform. Considering the obstacles, the country deserves high marks, perhaps a B+ grade, for its achievement of these goals over the past decade.

Trade between the Czech Republic and other nations in the world has expanded dramatically in the past ten years. At first, imports exceeded exports, and the country ran a large trade deficit. People of the Czech Republic understandably had a pent-up demand for the high quality products from the developed western economies. More recently, the trade deficit has diminished as the country has developed its export sector. Trade with the former communist states has decreased while trade with the European Union and European Free Trade Association has increased. Today, approximately 70% of the Czech Republic's trade is with developed market economies. Trade with Russia and the Commonwealth of Independent States (CIS) has dwindled to 25% of the total, and trade with developing countries represents the remaining 5%.

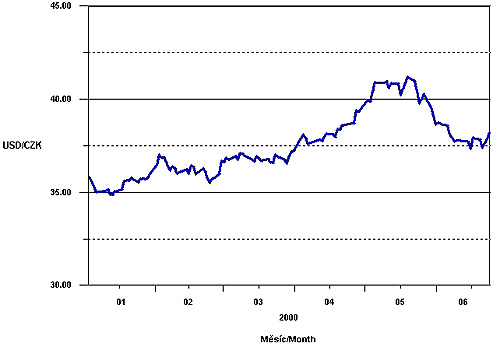

In 1990 the Czechoslovak currency was depreciated three times reflecting the artificially high official exchange rate of the crown. In 1997 the State Bank abandoned fixed rates and switched to a "free floating" system. The currency depreciated against the US dollar in 1997, appreciated 1998, and began to stabilize at about 36 CZK to the dollar in April of last year. One year ago the exchange rate was 36.257 CZK = 1 USD. On June 23 the exchange rate was 38.168 CZK = 1 USD. The recent stability the Czech crown reflects the central bank's restrictive monetary policy and high interest rates to curtail inflation. This attracts foreign investment flows into the Czech Republic.

Exchange Rate CZK per USD

Source: The Czech National Bank

Price stability is essential to maintain currency stability, and the Czech National Bank has committed itself to a long term policy of disinflation. Inflation in the Czech Republic has declined gradually from 20.8% in 1993 to 9.1% in 1995 to 2.1% in 1999. In April of this year the central bank published its annual inflation target for the end of 2001 to be 3%, plus or minus 1 percentage point. According to the central bank's April release, "The Czech economy has not yet entirely resolved its structural defects, high transactions costs and lack of flexibility, the overcoming of which is a precondition for sustained price stability. Moreover, it can be expected -- and the current trend already confirms -- that the positive supply and price shocks from the past period will be corrected in the opposite direction. On the other hand, the tendency towards increased low-inflation expectations and the gradual convergence of these expectations among economic agents is a positive signal."

Maintaining low inflation is a necessary condition for a successful economic transition. However, it requires the implementation of a restrictive monetary policy and high interest rates. This retards the rate of economic growth in the short run (at best) or precipitates a recession (at worst). In fact, the government's austere fiscal and monetary policies are said to be the cause of the Czech Republic's poor economic performance in recent years. Last year the nation's real GDP declined by -0.5% following a -2.3% decline in 1998. However, the International Monetary Fund (IMF) forecasts a +1.6% growth rate this year and a +2.7% growth rate next year. It would indeed be a positive development if the Czech Republic could keep inflation below 3% while its economy grows at nearly the same rate. Economies in transition are confronted with a delicate balance between the desire to grow rapidly and the necessity to maintain restrictive demand side fiscal and monetary policies. They must resist the temptation to stimulate the economy with deficit spending, social welfare transfers, and an easy money policy. For this reason, much of the economic growth in transition economies must come from the supply side.

Privatization can create a competitive business climate, enhance productivity, and stimulate economic growth. Early in the transition period the Czech Republic implemented a coupon privatization plan. The program enabled citizens to purchase coupon booklets of privatization points which they could exchange for shares in companies. Millions of Czechs participated in this plan. According to Professor Iraj Hashi (Staffordshire University - Division of Economics), "The mass privatisation programme in the Czech Republic has been hailed as one of the largest and most successful experiments in ownership transformation in transition economies. In the relatively short period of just over 4 years, the ownership of some 1700 large and medium sized enterprises were transferred to the private sector with the bulk of the adult population embracing the programme and participating in it actively."

However, the danger of privatization for many of the economies in transition is that government monopolies can simply be replaced by private monopolies if the new ownership becomes concentrated in the hands of a few. Corruption and cronyism can thrive. (Remember the figure of Greed on the Astronomical Clock). Professor Hashi's project study, Mass Privatisation and Corporate Governance in the Czech Republic (July 1997), investigated the process of ownership concentration following the country's privatisation program. It is a 34 page comprehensive report. His extensive study contains the following concluding remarks:

The

dangers here are moral hazard and the undermining of the integrity of

the

banking and governing institutions. When banks control a large

proportion

of the corporate industrial sector, there is a proclivity to engage in

corporate welfare. Banks tend to make riskier loans when it is

understood

that they will not be allowed to fail and are to be bailed out with

government

subsidies. Asset values tend to be overly inflated. If

ownership

and control is highly concentrated, then a few benefit at the expense

of

the many taxpayers. Ultimately, reality takes over and the

process

comes crashing down. It is a painful and politically devastating

experience.

The

dangers here are moral hazard and the undermining of the integrity of

the

banking and governing institutions. When banks control a large

proportion

of the corporate industrial sector, there is a proclivity to engage in

corporate welfare. Banks tend to make riskier loans when it is

understood

that they will not be allowed to fail and are to be bailed out with

government

subsidies. Asset values tend to be overly inflated. If

ownership

and control is highly concentrated, then a few benefit at the expense

of

the many taxpayers. Ultimately, reality takes over and the

process

comes crashing down. It is a painful and politically devastating

experience.

By all accounts, both the Czech government and the nation's central

bank are aware of these dangers. And it would appear that the

Czech

policies over the past decade have poured a firm foundation for an

effective

transition. The economy is now in the advanced stages of economic

transformation. An entrepreneurial culture has emerged in a

country

rich in history and tradition. Adult literacy is high in the

Czech

Republic's population of 10.3 million. The per capita GDP is now

nearly US $ 5,000. Foreign Investment is flowing into the country

primarily from Western Europe and the United States (See Table Below)

in

communications, consumer products, and auto production. Foreign

investment

helps to stabilize the exchange rate of a country that runs a current

account

deficit in its balance of payments. It also helps to stimulate

growth

in the economy. For all of the above reasons, the near term

prospects

for the Czech economy are very good and the long term prospects are

even

better.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All Other Countries |

|

|

|

|

Sources and Recommended Links:

http://www.cnb.cz (The Czech National Bank)

http://www.czech.cz/czech/economy (The Czech Economy)

http://www.insideczech.com (Inside Czech)

Hashi, Iraj. Mass Privatisation and Corporate Governance in the Czech Republic, (Division of Economics, Staffordshire University, UK - July 1997) published in Economic Analysis (vol. 1, no. 2, 1998).